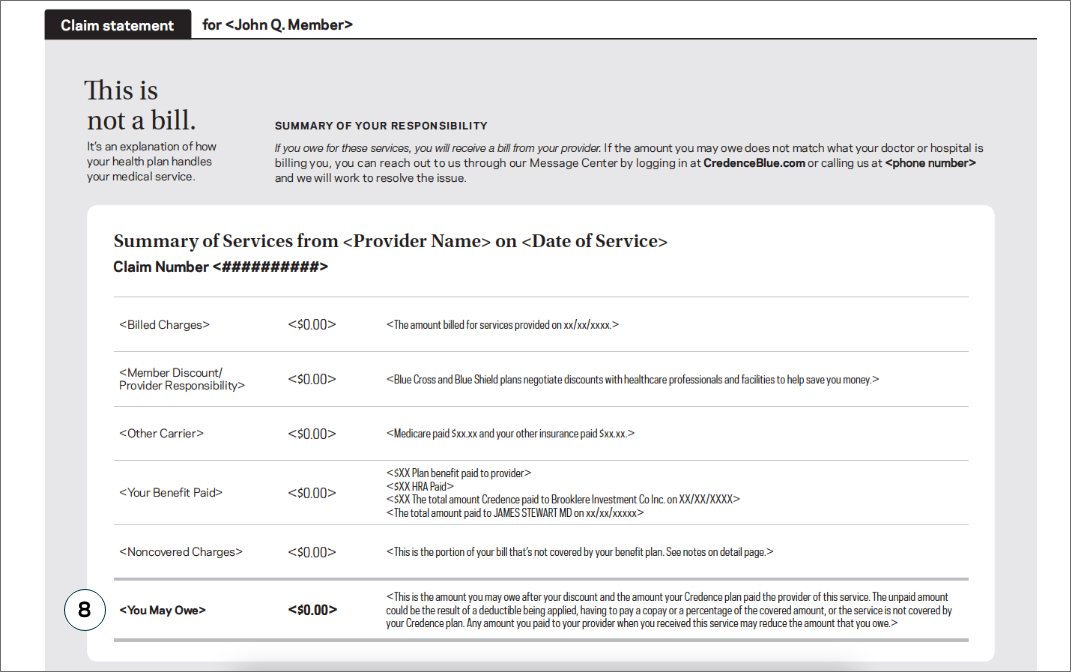

After you or someone in your family receives medical care, you can expect to receive a claim statement from us. This is not a bill, but it is more important than you may realize.

You should know your claim statement is not a bill, although it’s often confused for one. Instead, think of your claim statement as a receipt. Essentially, it’s a rundown of a recent visit with your doctor and how your healthcare plan helped you pay for it.

We think the fewer surprises in healthcare, the better. Reviewing your statement, even briefly, could help save you money in the long run and budget better for the future. So the next time you actually receive a bill, we’ve helped you plan for it.

The two things to look for:

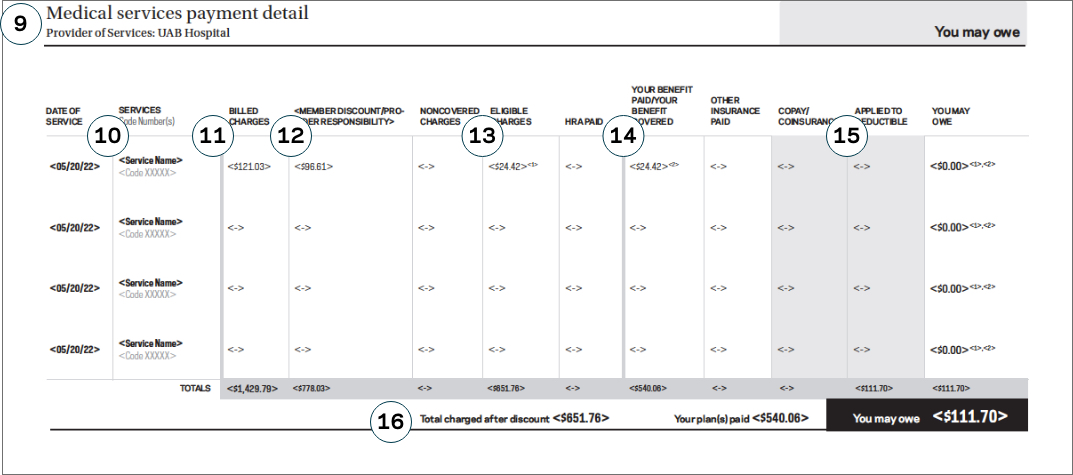

1. Check your medical services payment detail to make sure that the services claimed reflect the exact care you received. Informing your healthcare plan of any discrepancies—even if you didn’t pay for them—can help ensure your plan will cover more of your care in the future. That means paying close attention to your statement today could help you avoid out-of-pocket costs tomorrow.

2. Review your year-to-date summary to see where you stand on your plan—such as how much of your deductible remains to be met and your out-of-pocket maximum. Keeping track of your summary could help you avoid—and plan for—unexpected costs of care in the future.

How to read it

CONTRACT NUMBER

The contract number refers to the member ID, which should match the number on your Credence ID card.

SERVICES FOR

You may have several family members covered under your plan. The name here indicates who received care for this claim.

YOUR CLAIM STATEMENT

This is a reminder that your claims statement is not a bill. Instead, think of it as a receipt of care and recap of your healthcare plan activity.

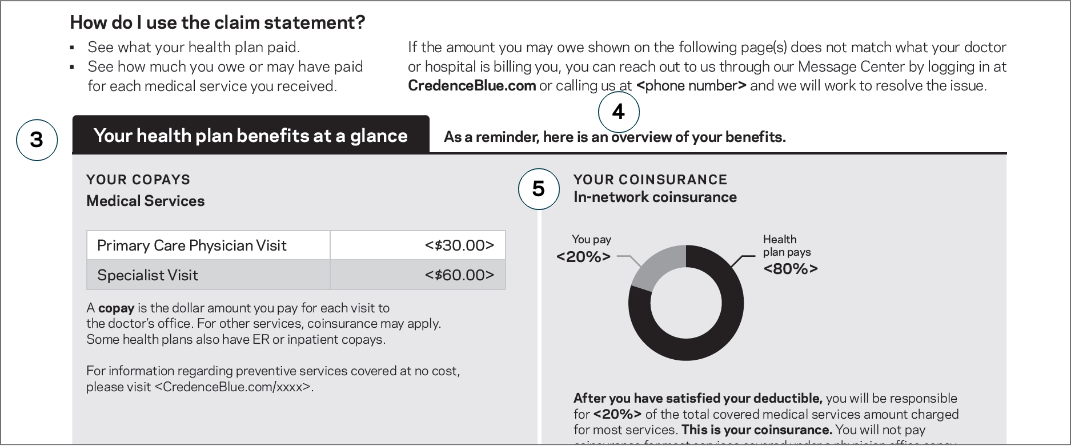

YOUR HEALTH PLAN AT A GLANCE

Overview of your benefits to help you anticipate future costs and as a reference point for your claim.

YOUR COPAYS

This section provides a general overview of your plan's copays. It's important to note that some services provided at your next visit may not be included in your copay.

CONTACT US

If you find any discrepancies or have questions, this is how you can contact us to discuss your claim.

YOUR COINSURANCE

Coinsurance is your share of the costs of a healthcare service. Remember, coinsurance coverage may not begin until after you’ve paid your plan’s deductible.

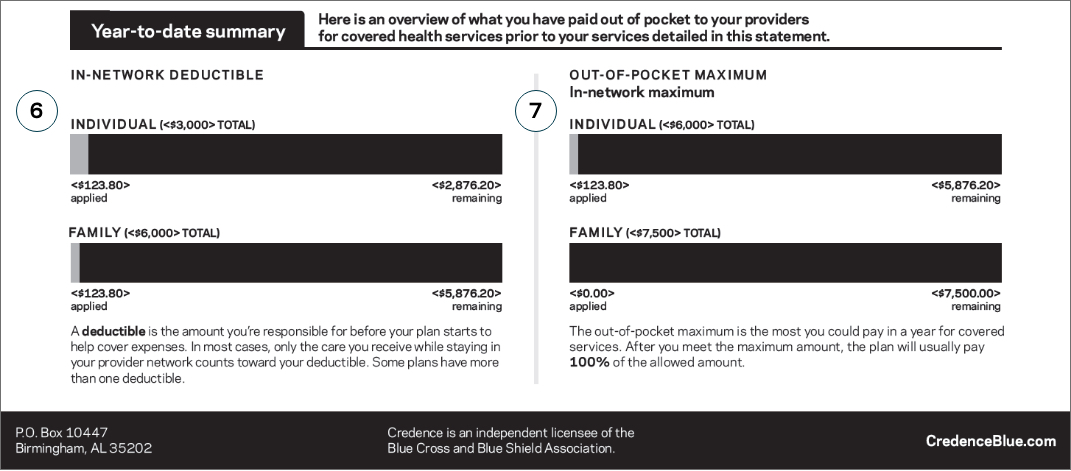

YOUR IN-NETWORK DEDUCTIBLE

Your deductible summary highlights the amount you’re responsible for before your plan begins to cover expenses for services not already covered by a copay.

YOUR OUT-OF-POCKET MAXIMUM

Your out-of-pocket maximum is the most you could potentially pay for care this benefit period, not including your monthly recurring payment, also known as your premium.

In most cases, if you have met both your full deductible and have paid your maximum out-of-pocket amount stated here, your healthcare plan will pay 100% of the services covered for the remainder of the year.

YOU MAY OWE

This total indicates how much you may owe or may have previously paid to your provider. If you do still owe your provider payment, the bill for services will be sent from your provider—not your healthcare plan.

YOUR PAYMENT DETAILS

This area presents an itemized view of the care provided as well as costs incurred.

YOUR SERVICE CODES

The service code is an assigned number that tells us what services were provided such as tests, evaluations, surgeries, and other procedures. These numbers guide our data to help us learn how we can build better healthcare plans for members like you in the future.

YOUR BILLED CHARGES

Your billed charges show the full cost of all services provided. This is how much you (or your healthcare plan) could have paid for your care before any member discounts, benefit coverage or coinsurance kicks in.

YOUR MEMBER DISCOUNT

The member discount indicates how much your healthcare plan saved you by negotiating care costs with your provider.

YOUR ELIGIBLE CHARGES

Your eligible charges are the maximum amounts charged for any service that qualifies for payment.

YOUR BENEFIT PAID

The amount your benefit plan paid for eligible and covered services received.

APPLIED TO YOUR DEDUCTIBLE

This number describes the amount of eligible charges applied to your plan’s deductible. If your deductible has been fully met, you may owe a portion of this dollar amount rather than the full amount. Refer to your benefits summary for more detail about your plan.

YOUR TOTAL

The three totals at the bottom of your claim statement sum up:

1. The total after your member discount

2. The total your plan(s) covered for you

3. The total amount you may owe or have previously paid your provider

What to do now

See something you don’t recognize? We’re here to help. You can let us know quickly through our Message Center by logging in at CredenceBlue.com, or you can call us at 1.833.663.8713. As we work to help you with the issue, you may want to save your statement as a reference.